the blog

How (and WHY) We Paid Off All Our Debt (Including the HOUSE!)

We just got back from our trip to Nashville where we did our Debt Free Scream live on the radio with Dave Ramsey. What is a Debt Free Scream you ask? Well the short version is it’s a way to celebrate your accomplishment of paying off your debt and a chance to tell your story on how and why you did it. I’ll share the link to our Scream at the bottom of this blog post if you want the quick and dirty version of our story, but I’m writing this blog post to share THE WHOLE STORY. From the beginning, with a lot more details. Buckle up. Let’s go.

It’s June 2016. Our daughter is 3 and our son is 2. I’m one year into starting my business and Mark is an untenured teacher working in a low-income school district. We had been living in our house for 2.5 years and honestly, we were just STUCK financially. It wasn’t a horrible situation, but we weren’t really making any progress for our future. I had always been pretty good with money. I was never a big spender and my parents taught me the importance of saving (thank you!). We tried to avoid debt but we didn’t necessarily HATE it. At this point in time we were $124,000 in debt:

- $288 in cell phones

- $5,800 on a car

- $8,000 on solar panels

- $18,000 in student loans

- $92,000 on the mortgage

And as there are no more secrets anymore since we did announce our income on the show, we were making $47,000 a year at this point. I felt pretty good because we didn’t have any credit card debt and I felt ‘okay’ with the debt we had. I mean, I WANTED to pay it off, but Mark and I had the mindset of, “well everyone has a car loan or student loans, so we’re okay.” We didn’t feel this strong push to pay it off ASAP and didn’t even really feel like we HAD to, just because it was, well, NORMAL.

Then, one Sunday, our church announces that they are going to stat offering Financial Peace University. I had heard a few couples who had taken the class and honestly I love anything relating to finance and saving money so I was like, “MARK! Let’s take this class!” He didn’t want to. I remember him saying, “We’re doing as good as we can with the money that we’re making – you’re a queen with the budget. We won’t learn anything there.” It was the end of the school year, he was busy, he was tutoring after school to try and make extra money, I had a busy wedding season coming up, so it just felt like another thing. But I kept feeling like we should do it. I felt like despite how busy we were, we should just try this. After a week or two of talking with Mark about it, he agreed, he’d take the class. We agreed that we could go to the class and if we didn’t learn anything or didn’t like what we learned, we can just continue doing what we’re doing since we felt okay with that anyway.

We start taking the class and a few weeks in they have the DEBT LESSON.

You know those moments in life where you can point to and say, “THAT’S when things changed,”? Well, that was one of those moments for us.

When we heard Dave Ramsey teach about getting out of debt as fast as you can and becoming a gazelle (you have to take the course to understand that metaphor!), we were just lit on fire. We went home and looked at all our numbers and started dreaming up: How can we get out of debt as FAST as we can?

This is when we got our WHY. Before, we were moderately comfortable with debt. It was normal, and we were fine being normal. But then we learned about this new way of living where you DIDN’T have debt and the freedom and peace that could come with that. We started to imagine what it would be like to not worry about money each month. We imagined the peace we’d feel if something terrible happened like Mark lost his job (remember, he was still untenured at this time!), or if an emergency popped up like we had to replace a hot water heater, or something really tragic happened like a death of one of us and having the financial piece be one thing we DIDN’T have to worry about. While the security was a big piece of it, it was was also knowing the freedom that would come from having no debt. The choices would open up for us: choices about vacations, home renovations, our ages when we retire, and giving our children options for their futures. The idea that we could go on vacations without the stress of the bills following us home, we could really make our house a HOME, and just having the OPTION to work or not during different seasons in our life was really freeing.

We visualized a life where we weren’t just OKAY with money, but GREAT.

After we watched that debt lesson, it was game on. We became the Morrell Gazelles. We were completely fired up. We went that week to AT&T to pay off our remaining installments on our cell phones so that we could get the debt snowball rolling. It freed up a measly $28/month that we then used to start paying down on our car faster.

The debt snowball is a method of paying off debt starting with the lowest balance. You pay off your smallest debt, then roll the money you were spending each month on that debt onto the NEXT smallest debt. Once that is paid off, you roll both of those monthly payments onto the NEXT smallest debt and so on. You make minimum payments on the rest of the debts you have but ATTACK the smallest debts one by one.

And we did the snow ball. We paid an extra $28/month on the car. But it wasn’t just that. We brought our emergency fund down to $1000 (as recommended by Dave Ramsey) and threw everything above that at the debt. Mark picked up some summer work at the local nature camp and worked as a counselor over the summer. I took on more weddings. I also started working at the kid’s preschool as a Teaching Assistant to make a little extra money. I meal planned and stuck to our budget that we laid out each month. We were doing anything we could to reduce our spending and throw everything extra at the debt as fast as we could.

The one thing we held onto for a little while though was our credit card. I had an Amazon credit card and LOVED my rewards. I got so much free stuff from Amazon because of my points! I didn’t want to give it up. BUT. Dave Ramsey recommends you cut up your credit cards. For a while, we felt like we didn’t have to because we NEVER went into debt on our credit card. We JUST used it for the perks!

But in April 2017, 10 months after we started the class and began the debt snowball, we really started to see how well the principles we learned in the class were working. At that point we had already paid off the cell phones, the car, and were only a few hundred dollars away from paying off the solar panels. In just 10 months we had paid off about $13,600 in debt (and we were only making $47k GROSS/year!) It was obvious the plan was working and Mark and I started to feel like maybe we needed to commit to the plan COMPLETELY. Let’s not just do PART of the plan, but let’s do it all the way. And we knew that that meant cutting up the credit cards and switching to cash.

We cut up the cards, had a long conversation on the phone with Amazon of them trying to convince us not to close our accounts, and picked up a few plastic envelopes to start using cash. This was a HUGE change for us in our debt free journey. Up until that point, we had been putting everything we spent on a credit card and then just tracked it at the end of the month. When we switched to cash we started doing everything in reverse. We planned out all of our spending BEFORE the month started and took out the cash ahead of time. Basically, we had the entire month spent before it even started instead of figuring out what we spent and paying for it afterwards. It was a big mindset shift and REALLY brought our financial life to the next level. This was also when we started using Dave Ramsey’s online budgeting tool, Every Dollar and really helped us to plan ahead of time rather than playing catch up later on.

And for those wondering about how we’re doing without our credit card rewards – well, we’re doing great! I tracked our progress for a full year and discovered that the amount of money we saved by using cash *FAR* outweighed the money we missed out on reward points. Seriously, it’s not even close. I can make another blog post another day if you’re interested to learn more about this, let me know if you are in the comments!

The final piece of the puzzle that we needed to do was tithing. Dave Ramsey is a Christian and has biblical principles that he teaches through the class. (If the Christian part scares you from taking the class, I urge you, get over yourself and open up your mind to learn something new, even if the person teaching it believes in something different than you do.) Mark and I were semi-new Christians at the time and really hadn’t learned much about tithing or giving generously. We were making so little, we felt like we didn’t have anything to give. But Dave teaches about putting giving at the TOP of your budget. You give first then everything else comes after that.

I once heard someone say they wanted to “build their generosity muscle” and I liked that. We decided to take it little by little. We’d increase our giving by $1 every week to our church. We kept doing that until we reached 10% of our income. And this is when it gets hard to explain things. My fellow Christians will know and understand that God can just do amazing things and you can accept my explanation at that. If you’re not a Christian, it may be hard to believe that I can’t come up with specific, tangible things to point to on how our money changed. But it did. Mark started getting more opportunities to work (AND HE TOOK THEM!) and my business started taking off, so yes we were making more money but some months it was just like, “how do we have this much extra to throw at debt?” or “how did that end up being cheaper than we thought it would?” I said during our Debt Free Scream with Dave Ramsey that God can change your money situation but can also change your heart. I want to expand on that a little bit more here:

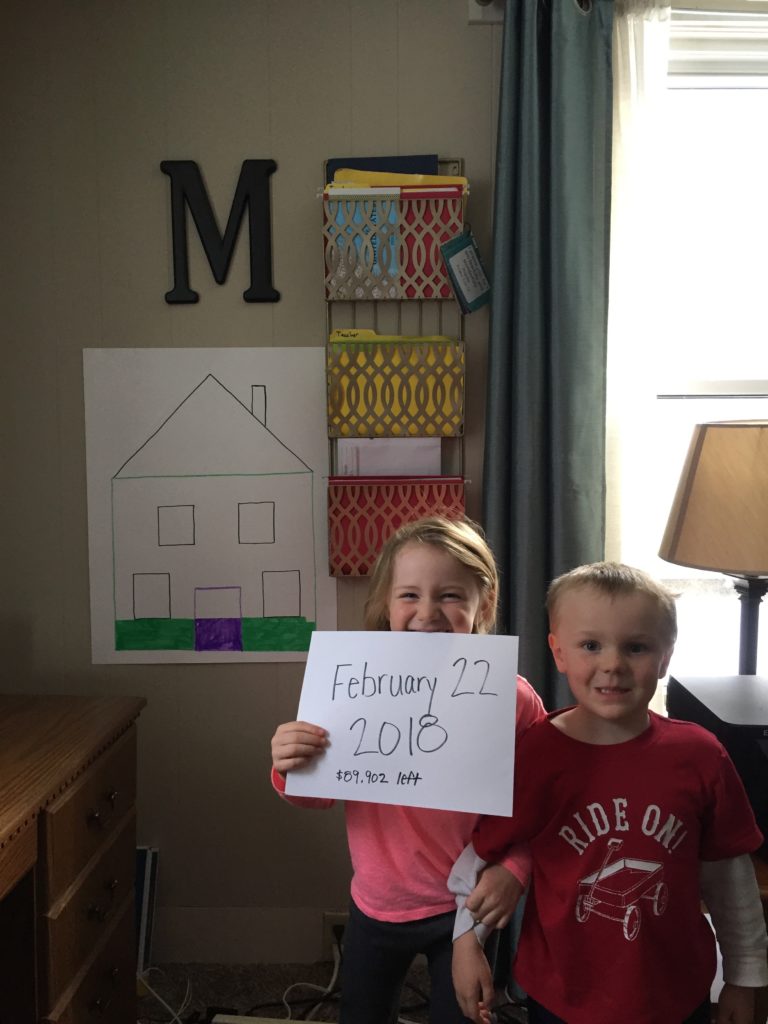

First, God changing your money situation. When we started tithing for real, God DID change our money situation. I’m not going to sit here and say that that will happen for EVERYONE because maybe it won’t happen the same way for you. I don’t know what God’s plan is for your life. But for us, jobs presented themselves to us. A specific example is the opportunity for Mark to become a NYS Master Teacher. This is a 4 year program where he participated in professional development sessions and networked with other local teachers in order to enhance their teaching and grow in their careers. You had to be a tenured teacher and apply and be accepted into the program. A quick side story here: Around February 2018, (we were a few months away from becoming CONSUMER debt free) I would dream of paying off our house but it felt like that was SO far away. It felt like it wasn’t something we’d be able to reach for another 10-15 years. But one day I was doing dishes and watching other Debt Free Screams on YouTube and I felt God say to me “6 years.” And I was just like, “no way.” And I heard again, “6 years.” I couldn’t believe it. I stopped doing dishes and started doing some math on my phone calculator. At the rate we were going, we’d need to come up with an extra $15,000/year to pay off the house within that time frame. I remember thinking, “HOW could we come up with an extra $15,000 a year??” Then I remembered the Master Teacher program, which at that point, Mark had just recently become eligible for. The application for the program had JUST opened and how much was the stipend per year? $15,000. I immediately called Mark, told him about the open applications and he started the process. A couple of months later, he was granted Master Teacher status and we vowed to put ALL of the money he made (save 10% to give away and a little extra for taxes, as they did not tax this money) towards the mortgage. God was right. He told me 6 years. And 6 years and 4 months after we started Financial Peace University, our house was paid off.

Secondly, tithing changes your heart. A lot of people don’t want to take FPU or follow Dave’s plan because it feels like you have to ‘give up’ too much. And, yes, we gave up a lot. We sacrificed. We said no. But, I do NOT feel like we missed out on anything. When we started tithing, a new kind of contentment and gratitude started to grow in our hearts that we hadn’t had before.

If anything, we had more fun and joy in our lives over the years of paying off debt than we’d ever had before.

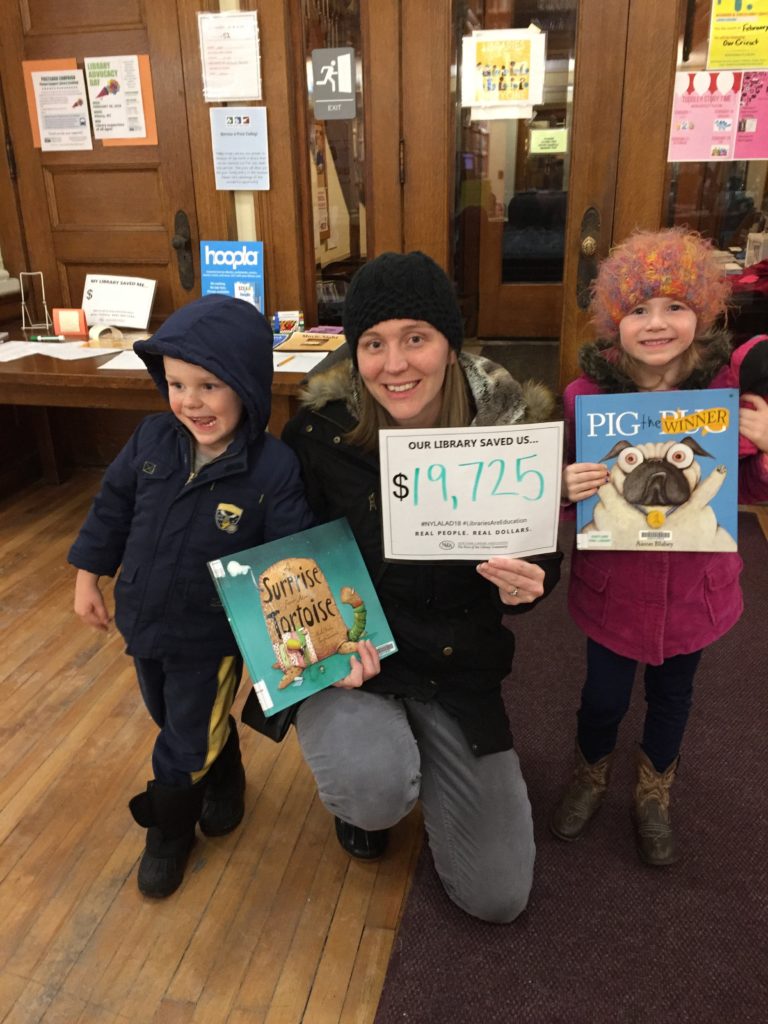

Just to give you some perspective, we only had 1 car for 6 years. Mark carpooled to school. I walked the kids to school in the rain and snow. We almost never went out to eat. When my grocery trip went over the amount of cash I had left in my envelope, I PUT FOOD BACK. When we DID do a trip, we ate peanut butter and jelly sandwiches in the car instead of buying lunch. We didn’t have any subscriptions. We spent *VERY* little money. From the outside, some may look at that and think, “I don’t want to live like that.” Or “life is too short.” Or there are a million other excuses on why living like that sounds awful. But, truly, I don’t feel like we missed out on anything. Sure, we delayed a few trips, but we still LIVED a LOT of life during this time. We found joy in simple picnics by the water and reading aloud books from the library, watching the sunset from the highest point in our town, playing flashlight tag in our house, and dance parties in our living room. It was always good enough. We were happy throughout this whole journey. I’m not just saying that. When you live in a world where you can see everyone’s epic vacation or new car or their fun meal out, it can be hard to look at your own life and not think, “flashlight tag? Really? I’m playing flashlight tag with my kids instead of having that awesome date night out with my husband?” But, really, I’m telling you, the contentment was real. It was short-term sacrifices for long-term gains. And that only came from putting God first in our finances. He changed our money and He changed our hearts.

Okay, Ashley, let’s start wrapping things up. So July 4, 2018, we became consumer debt free. Then we got our retirement and 529 funds going. Once those were underway, we started attacking the house. After the consumer debt was gone, we worked in a little more ‘expensive’ family fun like some Hershey Park trips in the summer and a few more date nights here and there. From fall 2018 until March 2020 we were making HUGE progress. All cylinders were firing. Then COVID happened. I lost more than half of my wedding videography income that year. We lost some momentum. We started wondering if we wanted to buy a different house. But we made a few changes in our house (like a small $4,000 kitchen remodel) that re-upped our love for our house and got back on that gazelle. All of 2021 and 2022 we put everything we could towards the house (AFTER tithing, retirement, 529 funds, and private school tuition, btw yes halfway through this journey we started sending our kids to private school and cash flowed that cost as well!). And finally, on October 15, 2022, we went to the bank and paid off the remaining balance of our mortgage.

It felt surreal for a while. But there’s also a peace and freedom that comes with it. I wouldn’t change anything about our journey. A million times I’d go back and I’d do the same thing we did. I’d make the same sacrifices. I’d work the same amount. I don’t regret paying off our house at all. Mark and I grew closer in our marriage, both of us grew in our faith, and we became more grateful, content people along the way. And we did it for our kids. We wanted to leave a legacy for them. We want them to know it’s okay (great, even!) to grow up WEIRD and live a life WITHOUT debt. I’m SO grateful we took Financial Peace University and that we went ALL in. It changed so much, more than I can even explain here in a blog post, but it was 100% worth it. Absolutely zero regrets.

And finally, here is our Debt Free Scream live on air with Dave Ramsey and George Kamel! It should start where we begin but if it doesn’t, we’re at 1:02:38!

I know, this was a LONG post! And I still feel like there’s so much more I could share, but I knew I had to wrap it up. PLEASE let me know if you read this and what parts you would like to know more about! I’d love to expand on different topics here in other blog posts: tithing, the debt snowball, credit cards vs. cash, how we had fun without spending money, etc. What topics are you most interested in? And look out VERY soon for another post about the behind the scenes of our Debt Free Scream and a video of our trip down to Nashville!

thank you for reading,

love, your debt-free girl,

::ashley

CATEGORY

2/24/2023

[…] a follow up from my previous post, How and Why We Paid Off All of Our Debt Including the House, I wanted to share about our trip down to Nashville, TN where we did our Debt Free Scream! This was […]

[…] coming up on 6 months of being 100% debt free, house and everything. And honestly, our spending hasn’t really changed that much. I’ve […]